Build Your Financial Legacy

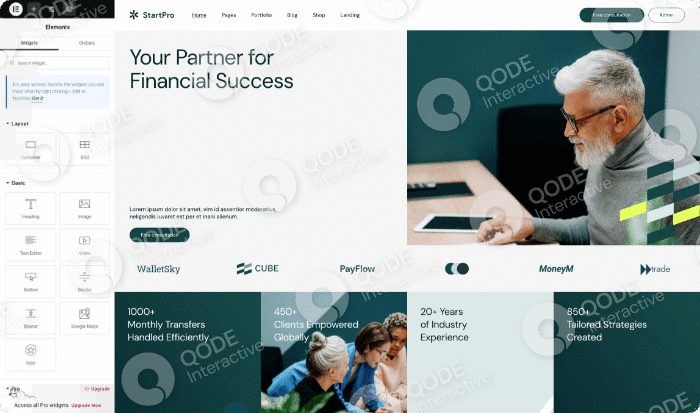

You can get the StartPro demo content in its entirety with just a single click of your mouse.

Compose, manage and edit your content with ease thanks to full Elementor compatibility.

Designed to offer completely open-ended customization possibilities, easily and in no time.

The typography selection is under your complete control with over 1K Google Fonts available.

Alter the main website color or the colors of any section & element the easiest way possible.

Sell online like a pro thanks to full WooCommerce compatibility & a great set of shop layouts.

Developed to make your new website look absolutely stunning on all devices & screen sizes.

Browse a detailed Knowledge Base, check out the theme user guide or contact support pros.

Loans not backed by specific collateral. Lenders rely on the borrower’s creditworthiness and cash flow. Often used with companies without physical assets.

Contract types:

Usual terms:

Usual eligibility criteria:

Loans backed by collateral (assets such as property, equipment, inventory, cash, IP, receivables). In case of default, the lender can seize the asset.

Contract types:

Usual terms:

Usual eligibility criteria:

Funding is repaid through a percentage of future revenue. Common for SaaS, recurring revenue businesses, or Ecommerce. It can take different forms of contracts and different types of repayment structures, depending on the business model and lender.

Contract types:

Usual terms:

Usual eligibility criteria:

Important note: RBF providers often uses a discount rate, not an interest rate. The discount rate determines the repayment cap (e.g., advance of €100k repaid as €110k = 10% discount) when the APR includes all fees and costs at the end of the facility repayments.

Advance against future card sales, repaid via a fixed percentage of daily sales. Suitable for both physical retail and Ecommerce businesses with card-based revenues.

Contract types:

Usual terms:

Usual eligibility criteria:

Short-term debt used to cover day-to-day operational needs (payroll, rent, supplies). It can take different forms:

loans, revenue-based financing, revolving notably.

Contract types:

Usual terms:

Usual eligibility criteria:

Loans secured by specific business assets (equipment, vehicles, inventory). This is a form of secured loan where the specific asset itself (like a van, machine, or inventory) acts as the collateral.

Contract types:

Usual terms:

Usual eligibility criteria:

Financing based on outstanding customer invoices. Offers early access to funds tied up in receivables. Can also include reverse factoring, where a lender pays suppliers on behalf of a buyer, improving payment terms across the supply chain.

Contract types:

Usual terms:

Usual eligibility criteria:

Debt funding for startups, often alongside or after equity rounds. Usually used to extend runway without dilution.

Contract types:

Usual terms:

Usual eligibility criteria: